Screening & Due Diligence Solutions

Screening & Due Diligence Solutions

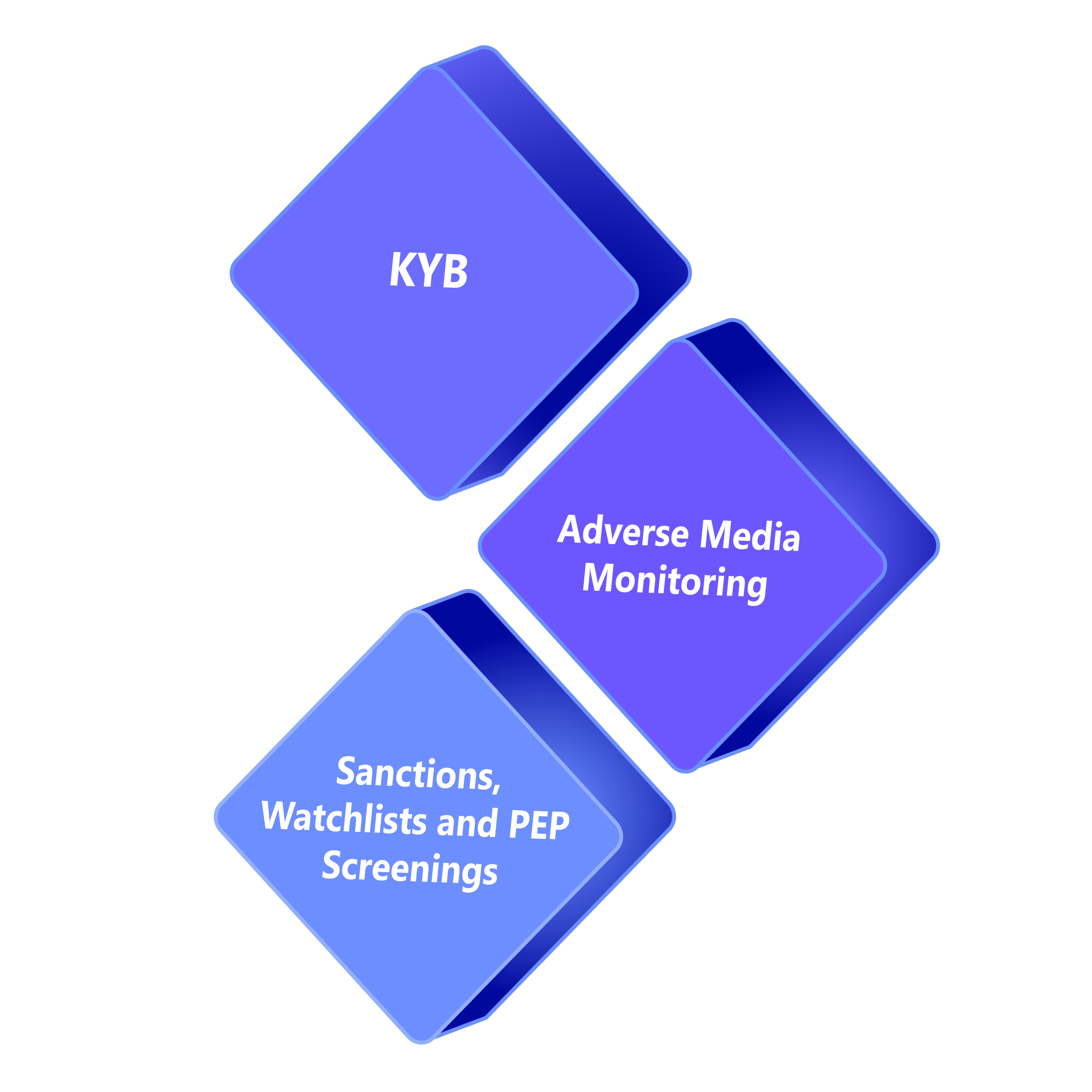

KYB, Adverse Media Monitoring, and Screening for Sanctions, Watchlists, and PEP

The problem

Ensuring compliance when onboarding and managing merchants is often a fragmented process that relies on multiple vendors. A rigorous process helps payment providers avoid reputational and regulatory risk by preventing the onboarding of bad actors.

On the other hand, overly complex or slow onboarding processes can deter potential merchants, hindering business growth and causing potential revenue loss.

How can banks and acquirers ensure that the onboarding process is both safe and seamless?

The solution

Powered by machine learning, our automated solutions cover KYB, adverse media monitoring, and screening for sanctions, watchlists & PEP, to manage risk at onboarding and throughout the merchant lifecycle.

For the 20% of findings that require a deeper dive, we offer enhanced due diligence services.

Automated, scalable solutions for screening and due diligence

KYB

Adverse Media

Sanctions, Watchlists & PEP

Efficient, effective onboarding enables growth

Focus on growth

Maintain compliance

Protect your brand